The bustling city of Charlotte, NC, is known for its vibrant economy. However, as with any urban center, there are moments when individuals face unexpected financial challenges.

The demand for financial alternatives has seen a rise, especially with the limitations of bank loans in meeting short-term monetary needs. This is where payday loans come into play, offering a quick and convenient solution for those in urgent need of cash.

It’s essential to understand the landscape, especially in Charlotte, and to be aware of the importance of these loans in enhancing the financial autonomy of the average citizen. As we delve deeper into this topic, we’ll discuss the complete payday loan process and everything you need to know about payday loans.

Payday Loans and Its Uses

A payday loan or cash advance is a type of short-term loan that provides borrowers with a small amount of money to be repaid by their next payday. Think of it as an advance on your paycheck. Unlike a traditional bank loan or personal loan that may require a lengthy application process and collateral, payday loans offer a streamlined approach. The application process is usually quick, often allowing borrowers to access funds on the same day or by the next business day.

Payday loans serve various purposes, offering a quick and accessible solution for urgent financial needs:

- Unexpected Expenditures: Payday loans are ideal for handling unforeseen emergencies like medical bills, car repairs, or urgent home repairs that require immediate attention.

- Bridging the Gap: They help bridge the financial gap when there’s a timing mismatch between bill due dates and your next paycheck, preventing late fees or service disruptions.

- Avoiding Overdraft Fees: Payday loans can keep your bank account in the black, preventing costly overdraft fees and penalties.

- Short-term Financial Shortfalls: These loans can assist during income fluctuations, such as job transitions or reduced income periods.

The annual percentage rate (APR) for payday loans may be higher, which is why they are best suited for short-term emergencies, not long-term financing. While payday loans have more accessible eligibility requirements, borrowers should use them responsibly and ensure they can meet the repayment terms.

Looking for a Payday Loan in North Carolina? Reach out to Loan For Success now.

How a Payday Loan in Charlotte Works

Payday loans are available and legal in North Carolina, including Charlotte, but they come with some tight rules to keep borrowers safe.

The law caps the loan amount at $500. This means you can’t borrow more than that through a payday loan. Plus, there’s a ceiling on interest rates too – lenders can’t charge you over 36% interest.

Also note that rollovers on payday loans are not allowed in North Carolina. This rule is part of the state’s strong regulatory framework to protect consumers from the potential debt spiral that can result from rolling over loans, which typically involves additional fees and extending the loan term.

Approval Criteria and Necessary Documentation

To ensure your payday loan application in Charlotte, NC, is successful, it’s essential to understand the approval criteria and have the necessary documentation ready. Here are the key factors that payday lenders typically consider:

1. Eligibility: As mentioned earlier, you must meet certain eligibility criteria, including being a resident of Charlotte, NC, and at least 18 years old.

2. Proof of Income: Loan companies need assurance that you have a source of income to repay the loan. This can be in the form of a job, regular government benefits, or other verifiable income. Prepare pay stubs, bank statements, or other documentation to prove your income.

3. Valid Driver’s License: A valid driver’s license or government-issued ID is often required to verify your identity.

4. Active Checking Account: You’ll need an active checking account where the loan funds can be deposited and from which repayments can be withdrawn. Lenders may also require a recent bank statement to confirm your account details.

5. Contact Information: Provide accurate contact information, including a valid email address and phone number, as lenders may need to reach out to you during the application process.

6. Social Security Number: Some loan companies may ask for your Social Security Number for verification purposes.

Having these documents and meeting the eligibility criteria will enhance your chances of approval when applying for a payday loan in Charlotte, NC. It’s crucial to be honest and provide accurate information during the application process to avoid delays or complications.

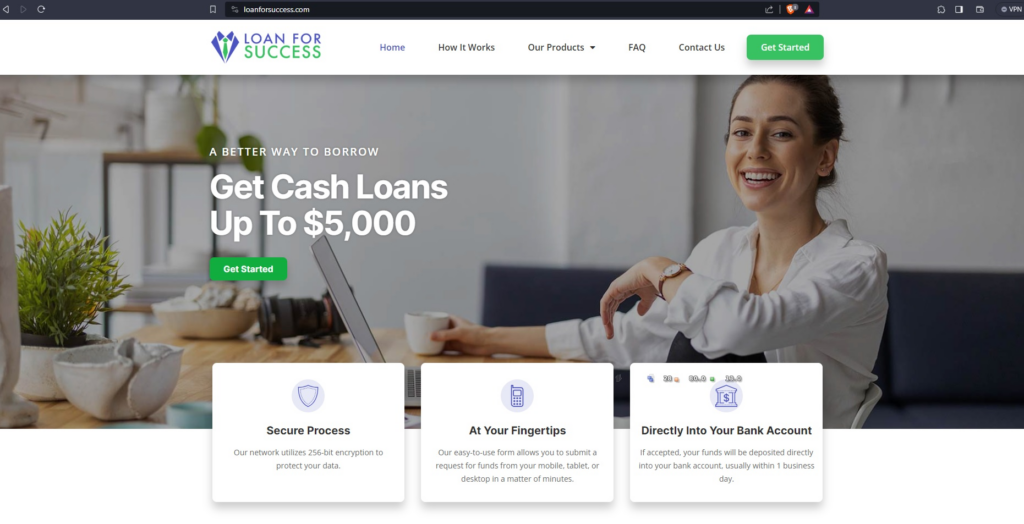

How to Apply for a Payday Loan in Charlotte, NC

In the hustle and bustle of Charlotte, North Carolina, unexpected expenses can sometimes catch you off guard. When you find yourself in need of some quick cash to cover those unforeseen bills, payday loans can be a viable solution.

Step 1: Determine Your Eligibility

Before diving into the payday loan application process, it’s crucial to ensure you meet the eligibility criteria. In Charlotte, NC, you must be a resident and at least 18 years old. You’ll also need a valid driver’s license, proof of income, and an active checking account. Meeting these requirements will boost your chances of approval.

Step 2: Find a Reputable Payday Loan Company

Now that you know you’re eligible, the next step is to find a trustworthy payday lender or loan connecting service in Charlotte, NC. Loan For Success, a well-established player in the unsecured finance market, can streamline the process for you. Our network of lenders ensures you get access to the best payday loan options available.

Step 3: Submit Your Loan Request

With Loan For Success, you can easily submit your loan request online. Their user-friendly form is accessible from your mobile, tablet, or desktop, allowing you to apply from the comfort of your home. Simply provide the necessary information and loan amount, and you’re on your way to financial assistance.

Step 4: Get a Quick Decision And Receive Your Funds

One of the advantages of payday loans is the swift decision-making process. In Charlotte, NC, you can expect to receive a decision on your loan application in minutes. This is particularly helpful when you’re dealing with urgent financial needs.

Upon approval, your funds will be directly deposited into your bank account. In most cases, this happens within one business day. This hassle-free transfer ensures you can quickly address your financial obligations.

Working with reputable loan connecting services like Loan For Success can also simplify the approval process and provide you with the financial support you need quickly and efficiently.

Benefits of Getting a Payday Loan in Charlotte

When unexpected financial challenges arise, payday loans in Charlotte offer a lifeline to individuals facing urgent expenses. Here are some key benefits of opting for a payday loan:

- Swift Access to Funds in Emergencies: Payday loans provide an expedited solution, ensuring you receive the needed funds quickly. In many cases, you can get approval within minutes, allowing you to address pressing financial issues promptly.

- No Need to Involve Personal Contacts or Acquaintances: Unlike borrowing from friends or family, payday loans from direct lenders maintain your financial privacy. You can secure the necessary funds without having to rely on personal contacts, making it a discreet option.

- Flexibility in Repayment: Payday loans typically have short-term repayment terms, aligning with your next payday. This flexibility means you don’t have to carry the burden of debt for an extended period, helping you regain financial stability sooner.

- Less Stringent Criteria Than Traditional Banking Facilities: Payday loans are accessible to individuals who may not meet stringent bank criteria. This inclusivity ensures that a wider range of Charlotte residents can benefit from this convenient option.

While payday loans offer several advantages, it’s essential to be aware of the associated high interest rates and to borrow responsibly. By understanding the terms and conditions provided by your chosen lender or loan connecting service, you can make an informed decision and use payday loans as a valuable tool in managing unforeseen financial challenges.

Can You Get Online Payday Loans With Bad Credit?

Your credit score plays a pivotal role in traditional loan applications, but online payday loans in Charlotte, NC, often cater to those with less-than-perfect credit histories. Traditional lenders scrutinize credit scores to assess an applicant’s creditworthiness and risk.

Online payday loans offer not only accessibility but also faster approval times, with Loan For Success providing near-instant decisions, allowing you to address your financial needs promptly.

Does Loan For Success Offer Payday Loans in North Carolina?

Absolutely, in North Carolina, Loan For Success facilitates connecting individuals with trusted payday lenders. Although Loan For Success doesn’t directly provide payday loans, they assist in linking you with reputable lenders via their platform.

Understanding the urgency of financial emergencies, their focus is to swiftly connect users with a lender. The approval process aims to deliver near-instant decisions without compromising user safety.

How Fast Can I Get the Money?

After submitting your loan request, lenders in our network aim to provide a decision within minutes. If approved, the funds are typically deposited directly into your bank account by the next business day, ensuring you receive the money promptly.

The time it takes to access your funds can vary based on factors such as your lender’s processing times, the accuracy of your provided information, and the time of day when you apply.

Choosing online loan connecting companies like Loan For Success known for their efficiency can expedite the disbursement process, offering you the financial support you need precisely when it matters most.

Loan For Success’s Commitment to Healthy Lending Practices

Loan For Success is dedicated to responsible lending practices, prioritizing the financial well-being of our customers. Our commitment revolves around the following principles:

- Philosophy of Responsible Lending: We believe in offering financial solutions that empower borrowers without burdening them. Our adherence to regulations, including the Consumer Finance Act, ensures a fair and ethical lending environment.

- Borrower Well-being: Safeguarding our borrowers is our top priority. We assess applicants’ financial situations responsibly and protect them from turning to predatory lenders, fostering a secure borrowing experience.

- Transparent Fees: We maintain complete transparency by clearly outlining all fees upfront, fostering trust and informed decision-making.

- Flexible Repayment Options: Recognizing individual needs, we provide flexible repayment plans, reducing the risk of financial strain.

- Financial Education and Support: Beyond lending, we offer resources and guidance to enhance financial literacy, empowering borrowers to make sound financial decisions.

Our direct deposit system ensures swift fund disbursement, while our streamlined online applications provide convenience. Loan For Success is synonymous with a convenient option for those facing financial emergencies. Partner with us for responsible, transparent, and supportive lending solutions.

Conclusion

In the dynamic financial landscape of today, the indispensability of payday loans cannot be overstressed. They serve as a pivotal financial bridge for countless individuals, especially during unpredictable financial tight spots. While there are myriad lending options out there, choosing a trustworthy and efficient loan company is paramount. Loan For Success stands out in this regard, with its stellar and swift service.

Always ensure you’re clear on the loan terms and payment structures to make the most informed decision. Remember, it’s not just about getting funds; it’s about financial empowerment and choosing options that align with your unique needs. Trust in stellar services that stand by their promise, and navigate your financial journey with confidence.

With Loan For Success, you’re eligible to qualify and typically receive the funds you need. Dive into a hassle-free online application and see how we can make your financial dreams a reality!

FAQs

Can you get a payday loan in NC?

While North Carolina has restrictions on storefront payday loans, residents aren’t left without options. Thanks to online platforms like Loan For Success, individuals in NC can conveniently request payday loans from their homes. With the platform’s efficient process and dedication to service, obtaining a payday loan online from various lenders in NC has become a seamless experience for many.

What is the easiest payday loan to get approved for?

Payday loans with minimal requirements are typically the easiest to obtain. Loan For Success stands out by emphasizing a user-friendly process that centers on core qualifications like steady employment and consistent income. This online provider ensures that thanks to their commitment to payday loans, borrowers can expect timely and swift approvals.

How to get $100 dollars instantly?

For a quick $100, online payday loans offer a reliable solution. Using Loan For Success, one can benefit from a rapid approval system designed to deposit funds promptly. Their platform’s user-friendly interface coupled with a dedicated support team ensures a smooth transaction. Their service makes securing an immediate $100 not merely feasible, but also uncomplicated and stress-free.